Workers on the payroll who earn more than S/ 2,475 per month this year will pay Income Tax. The payment of the IR varies according to the level of salary.

As a worker has a higher salary, he must also pay more Income Tax (IR). To calculate the IR to be paid by workers with fifth-category income (on the payroll), 7 UIT is deducted from their annual income (14 salaries), which will be S/ 34,650 this 2023, since the UIT rose from S/ 4,600 to S/ 4,950.

After this deduction of 7 UIT, the IR rate is applied to the resulting balance. Those who earn up to 7 UIT per year will not pay IR. This 2023, those who earn up to S/ 2,475 per month will not pay IR (2,475 x 14=34,650).

How much will workers who earn more than 7 UIT pay in IR this 2023?

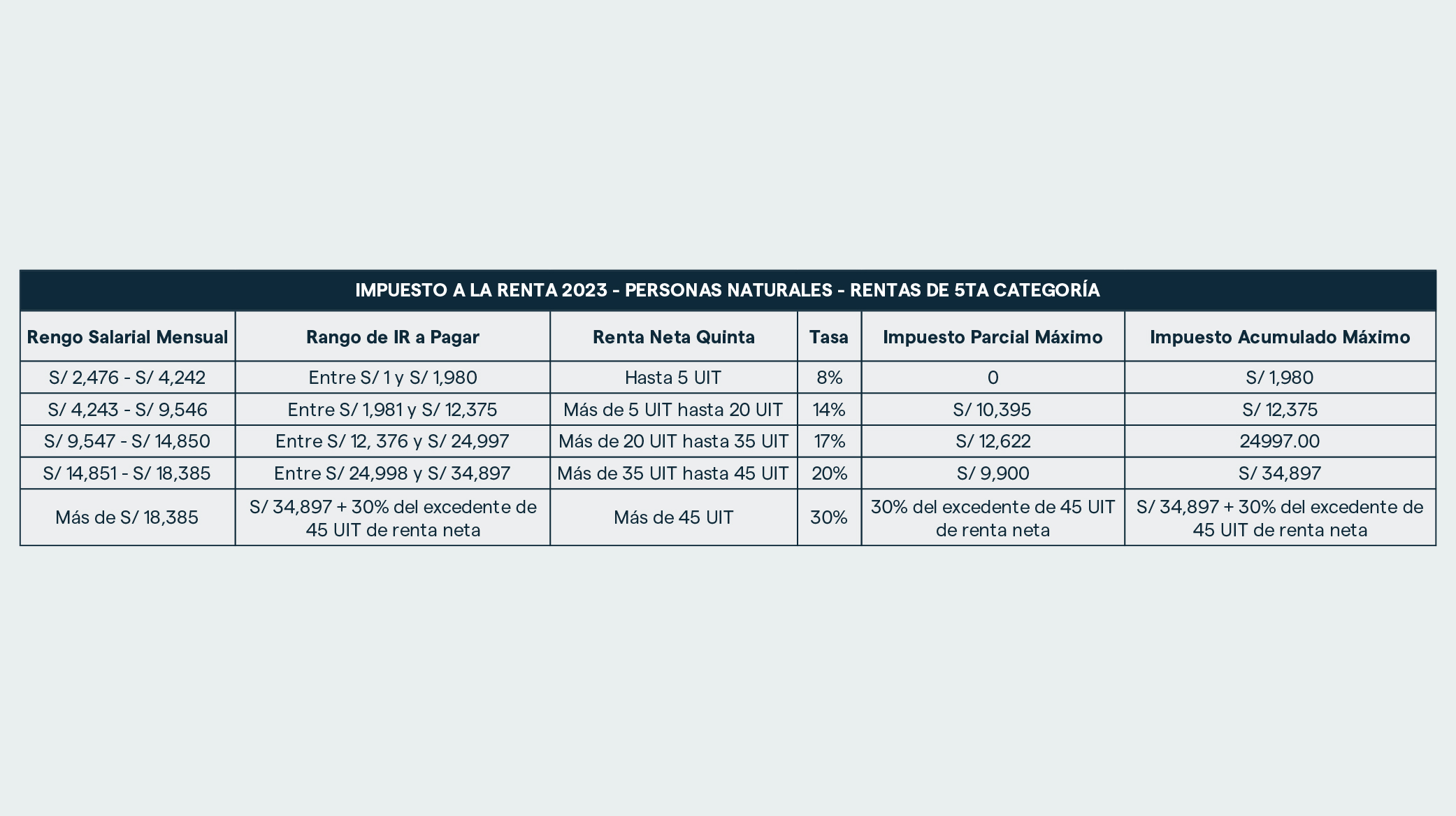

An IR rate is applied to the amount of income in excess of 7 UIT, differentiated by sections.

Thus, if the excess amount of the 7 UIT is located up to 5 UIT, a rate of 8% will be applied on this amount and the result will be the tax to be paid. For the section between 5 to 20 UIT, the IR rate will be 14%.

For the stretch between 20 and 35 UIT, the IR rate will be 17%; for the stretch between 35 and 45 UIT the rate will be 20% and for the stretch above 45 UIT the rate will be 30%.

Taking these variables into account, those who in 2023 earn between S/ 2,476 and S/ 4,242 per month, will pay IR between S/ 1 and S/ 1,980.

Likewise, those who earn between S/ 4,243 and S/ 9,546, will pay IR between S/ 1,981 and S/ 12,375. And so on, the tax to be paid will be higher as the worker receives more income (see table).

In this regard, Giorgio Balza, principal associate of the Cuatrecasas study, stressed that the increase in the UIT for this year will favor workers, since it will mean that they will pay less taxes.

This is more appreciated in the case of workers who maintained their same salary level from one year to the next. The tax lawyer prepared a table where you can see how the tax payment will be reduced this year for various cases, depending on your salary level.

For example, in the case of a worker who earns S / 4,285 per month, in 2022 he paid IR a total of S / 2,512; while this year he will pay IR S / 2,064 (see more cases in the following table).

Balza specified that these estimates on the IR to be paid are made without considering the possibility that workers may make an additional deduction of up to 3 UIT in the calculation of their IR payment, based on expenses sustained in restaurants, hotels, bars, payment of professional services, among others.

For his part, the tax lawyer Walker Villanueva, partner of the PPU study, explained that it is the employers themselves who, at the beginning of each year, carry out a projection on the level of annual income of each worker, and based on this, they determine who will be exempt from IR , and who will pay.

In these cases, the employer applies the discount to each monthly salary deposit, which is recorded on their pay slips.

Source: Management