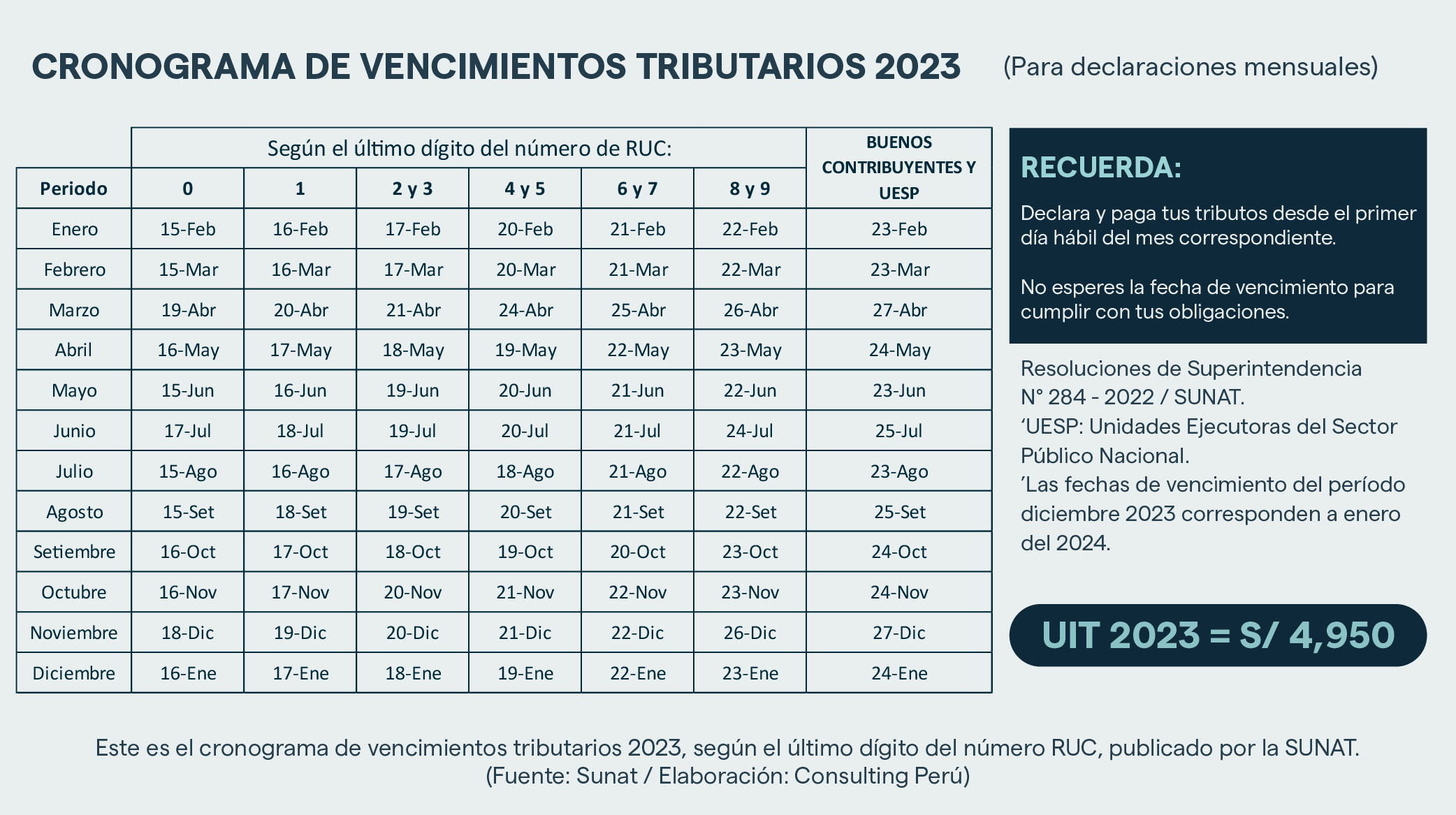

Know the new date to be able to present your declaration, according to your RUC number.

The National Superintendence of Customs and Tax Administration extended the term for the monthly declaration and payment of taxes for the period December 2022. Learn about the new schedule, as well as who can access this benefit.

The entity indicated that this is one of the measures announced by the Ministry of Economy and Finance (MEF) in order to reactivate economic activity.

WHAT IS THE NEW DEADLINE TO SUBMIT THE TAX RETURN?

The tax declaration for the period December 2022 may be submitted between February 15 and 23, 2023, according to the last digit of its RUC, that is, 30 days after the initially established period, indicated the National Superintendence of Customs and Tax Administration (Sunat).

Meanwhile, the new maximum delay dates for the records of sales and income and electronic purchases corresponding to the period December 2022, will be from February 14 to 22, 2023, according to its last RUC digit.

WHO CAN ACCESS THE EXTENSION OF THE TAX RETURN?

The new deadlines for the declaration and payment of monthly taxes will apply to taxpayers who, in the period November 2021 and October 2022, have obtained income from Third Category Income (business income) that does not exceed 1700 UIT. The norm indicates that the extension for the presentation of these monthly obligations covers:

Taxpayers of the new RUS between November 2021 and October 2022.

Natural persons who have not had income that qualifies as third-category income nor have been subject to the new RUS between November 2021 and October 2022.

Unaffected taxpayers of income tax (IR), other than the national public sector. (Between November 2021 and October 2022).

Taxpayers exempt from IR and carry out, only, operations exempt from the general sales tax (IGV). (Between November 2021 and October 2022).

WHAT HAPPENS IF THE TAXPAYER HAS LESS THAN 12 MONTHS OF ACTIVITY?

The Sunat indicated that, if the taxpayer has less than 12 months of economic activity as of October 2022, the periods since the activity began are considered.

MORE INFORMATION

Taxpayers can contact:

Telephone consultation center: 0-801-12-100 or 315-0730

Web: sunat.gob.pe

MORE INFORMATION ABOUT SUNAT

WHAT HAPPENS IF I AM DELAYED IN FILING THE RETURN AND PAYING THE INCOME TAX?

According to the Sunat page, not submitting the declaration and paying after the deadline has consequences:

The fine is equivalent to half the UIT (S/ 2,475) if the offense is committed in 2023, but if the Sunat has not yet notified you, you will only have to pay 10% of it, which is S/ 248 plus interest moratoriums.

Source: The Trade